Photo Courtesy of Island Country Club, Marco Island Florida

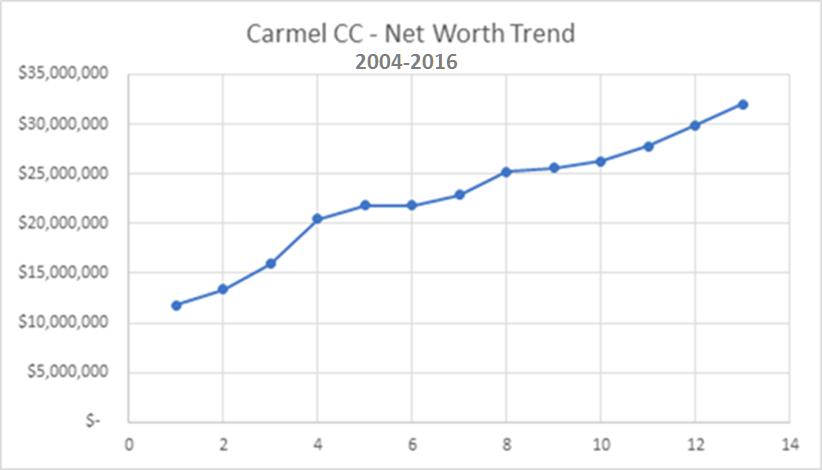

Florida’s Island Country Club Lays Solid Foundation for Future Success

Debuting as Marco Island’s only golf club, Island Country Club first opened for business in 1966. Offering an 18-hole...

.png?width=200&height=58&name=MicrosoftTeams-image%20(8).png)

.png)