If just one rule could be instituted in every club boardroom with the goal of making the entire industry healthier, it would be this… Every time a Board member is tempted to bring up the subject of F&B profitability, they have to stop themselves and replace that topic with two critical questions:

If just one rule could be instituted in every club boardroom with the goal of making the entire industry healthier, it would be this… Every time a Board member is tempted to bring up the subject of F&B profitability, they have to stop themselves and replace that topic with two critical questions:

- What are our future capital needs?

- What are our projected capital resources?

Capital planning is at once the biggest challenge and the best opportunity for improvement in clubs, and yet few clubs seem to fully recognize its importance.

There are two easily calculated measures that managers and boards can use to gain keen and immediate insight into their club’s capital situation: Net Worth (owner’s equity in a for-profit club and unrestricted net assets (UNA) in a not-for-profit club) and the Net Available Capital to Operating Revenue Ratio.

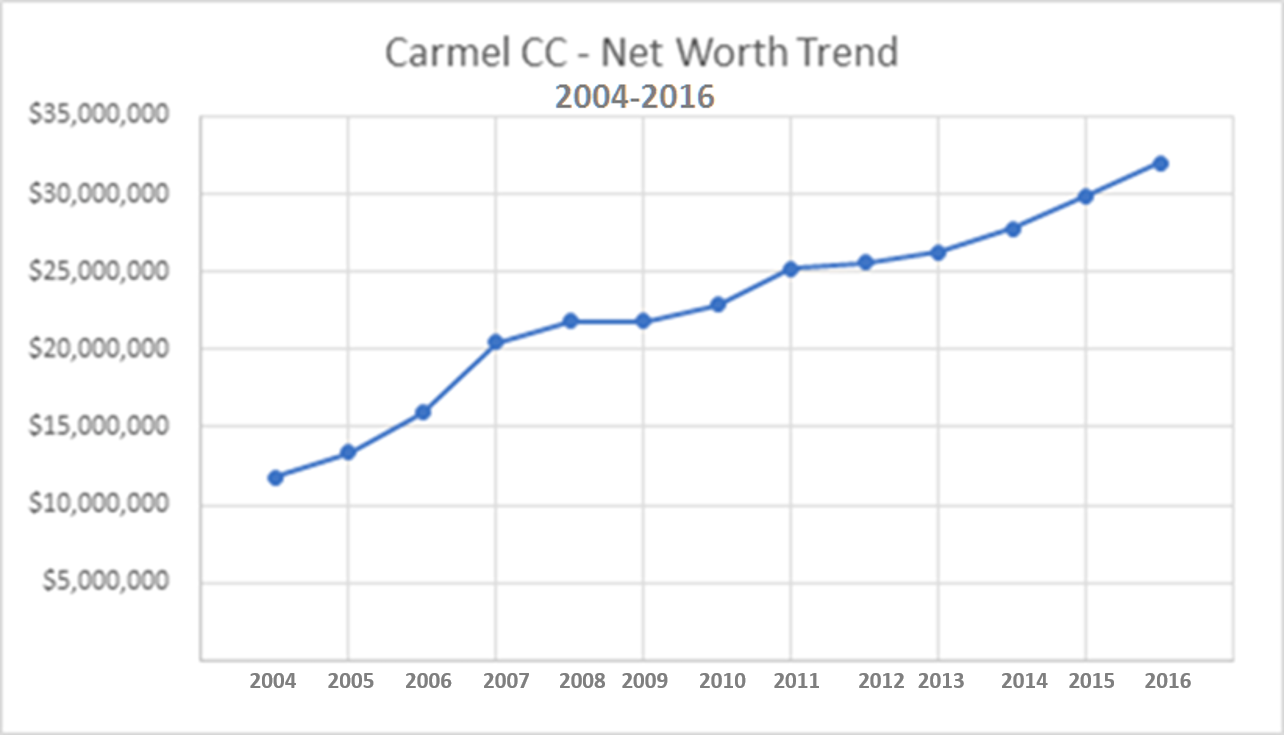

Understanding the club’s Net Worth over time begins by assembling ten years of audited financial statements. Search the documents for “Owner’s Equity” if you’re a for-profit club or “Unrestricted Net Assets” (UNA) if you’re a not-for-profit club. Enter the number for each of the ten years into a spreadsheet and plot a simple line graph using that data. The resulting graph shows your club’s net worth over time and clearly illustrates whether your UNA is increasing, going sideways or declining.

The chart below shows a real-life example of UNA or Net Worth over time, plotted in this case by Carmel Country Club in North Carolina. The club’s impressive growth, from a net worth of about $12 million in 2004 to more than $30 million in 2016, is a direct result of a strong commitment to capital investment on the part of club’s Board and Management. The club’s consistent cycle of investment has, over time, produced amenities that increase the value of being a member of the club. Strengthening the club’s value proposition supports increases in initiation fees and dues and as a result, the club’s UNA is on a very healthy upward trajectory.. The second exercise, calculating your Net Available Capital to Operating Revenue Ratio, draws on the financial statements you gathered to study Net Worth. Using data from the financial statements, calculate your club’s earnings before income taxes, depreciation and amortization (but after covering expense of interest on debt). The result of that calculation is called Net Available Capital. It is the money remaining at the end of each year that can be used to pay down debt, make capital investment or put money in the bank.

The second exercise, calculating your Net Available Capital to Operating Revenue Ratio, draws on the financial statements you gathered to study Net Worth. Using data from the financial statements, calculate your club’s earnings before income taxes, depreciation and amortization (but after covering expense of interest on debt). The result of that calculation is called Net Available Capital. It is the money remaining at the end of each year that can be used to pay down debt, make capital investment or put money in the bank.

Analysis of industry data shows that at a minimum, clubs must generate Net Available Capital equivalent to 12% to 15% of their total operating revenue every year. One quarter of clubs generate 7% or less (capital starved clubs) and at the high end of the spectrum, a quarter of all clubs generate more than 17% (capital rich clubs). Fifty percent of all clubs aren’t generating the necessary capital over time. If your club’s Net Available Capital is below 12% and especially if you are in the sub 10% range, you are very likely feeling the stress of too little capital – you may even see the evidence when you look at your physical assets.

Those two quick, but critical, ratios will yield great insight. Now let’s address how to use the ratios as a catalyst for constructing a plan. There are three key points related to capital planning and aligning a Board and membership on this important issue.

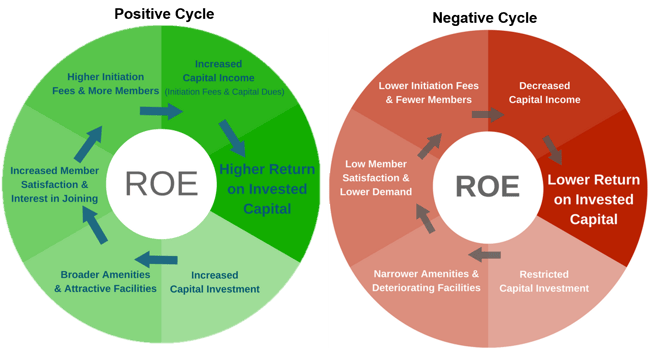

- Industry data shows that clubs investing continuously over time have a higher rate of return on equity than clubs restricting investment. Capital investment is a momentum game, meaning the more you invest, the more money you will generate for further investment, through higher capital income. The less you invest, the less money you will generate because you won’t be attracting members willing to pay a reasonable initiation fee to join the club. During the last financial meltdown, many of the clubs that reduced or eliminated their initiation fee are now capital starved clubs.

- Every club should have a capital reserve study conducted by an objective, 3rd party professional with experience specific to private clubs. We believe a 20-year forward projection is necessary to ensure financial sustainability and consistency in the club's value proposition. The Capital Reserve Study serves as a running projection of your club’s capital needs over time, so you can develop a rational long-term capital investment plan and focus on determining where the resources will come from to meet the needs.

- Club Benchmarking data shows clubs must focus on a tangible value proposition by continuously investing to create value if they are to succeed over time. If a club is focused only on cost cutting and not the value proposition, the data shows those clubs are likely to get swept into a cycle of decay that will be difficult if not impossible to reverse.

.png?width=200&height=58&name=MicrosoftTeams-image%20(8).png)

.png)

-1.png)

-1.png)