Private clubs operate in an industry that is highly fragmented and they are far more complex than revenues might suggest. Constitutions, bylaws and operating practices tend to be homegrown. Board member terms are relatively short by commercial...

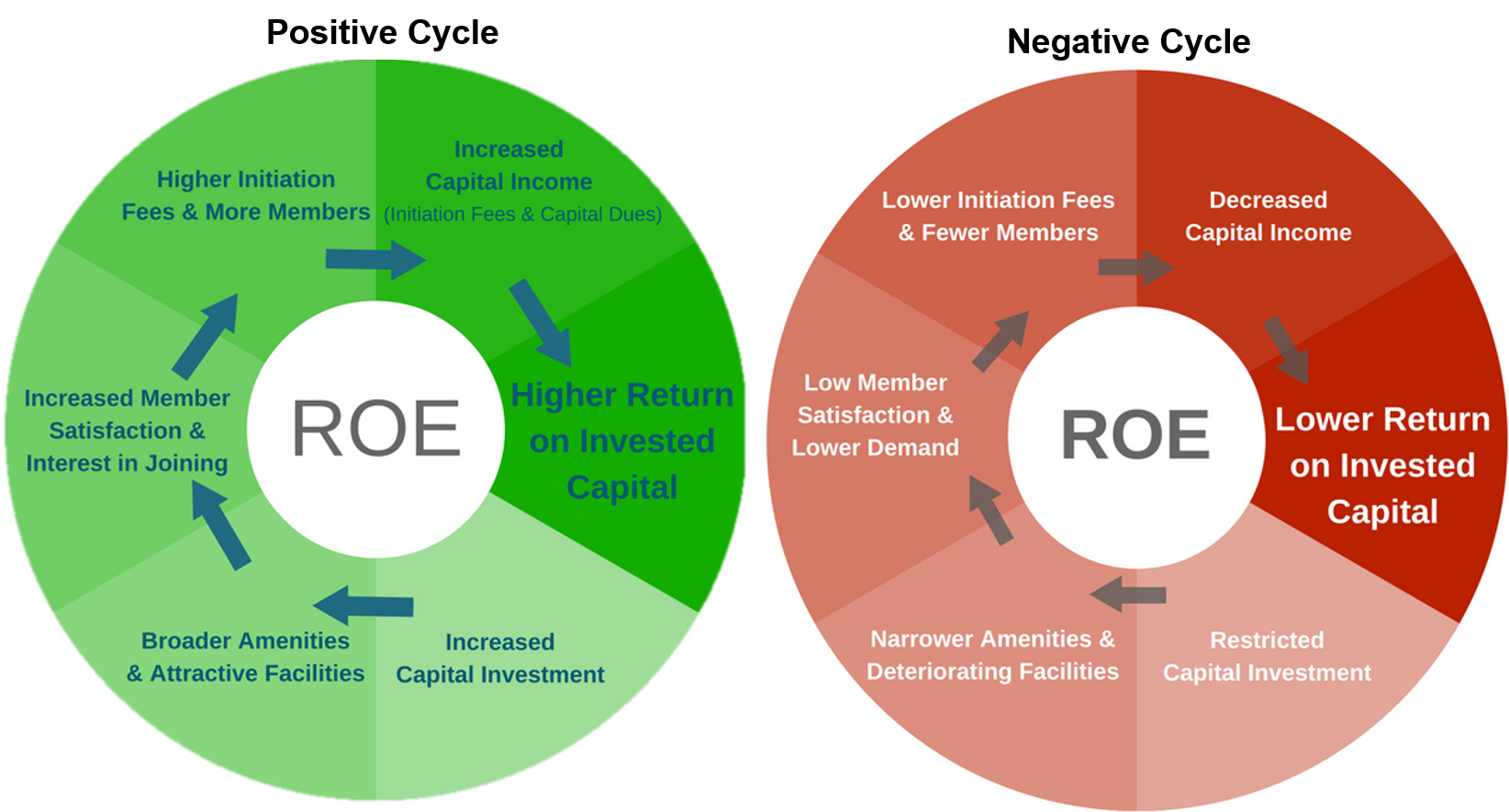

Transformative investments of millions of dollars are reshaping private club campuses everywhere, and “What’s this going to cost?” is a question often raised in member forums and club board meetings. Club leaders need to put in the work and be...

"We can't control the wind, but we can adjust the sails."

I don't sail much any more, but that adage definitely speaks to me as I reflect on what we've all been faced with over the last six weeks. I am a self-confessed data geek who has been...

Now Might Be a Good Time to Rethink Your Club’s Business Model...

Over the coming weeks and months, clubs will be faced with lost revenue due to sustained closures and challenges related to retention of staff and members. Some clubs will emerge from...

Originally published by the National Club Association in the Fall 2019 issue of Club Business Magazine.

Prior to joining Club Benchmarking as CEO in 2017, I enjoyed a wonderful career in club management that began in 1984. Along the way I had the...

Is your "Senior" membership category out of balance? How are fees and policies related to that category impacting the club's financial health?

CB Member Resources: In this article we'll be looking closely at two slides: Senior Members and Senior...

Originally published by the National Club Association, Club Director Magazine

Originally published in NCA Club Director Magazine Fall 2018

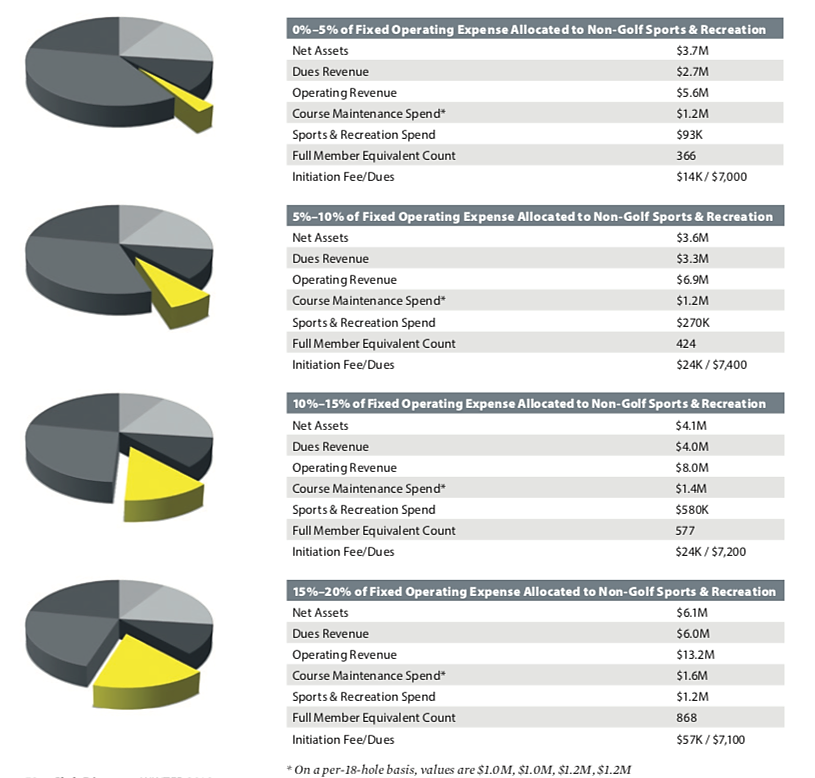

CLUB BENCHMARKING DATA REVEALS a “Tale of Three Cities” happening in the club industry, and we are deeply concerned about what appears to be a growing divergence. According to our...

.png?width=200&height=58&name=MicrosoftTeams-image%20(8).png)

.png)

.png)