Now Might Be a Good Time to Rethink Your Club’s Business Model...

Over the coming weeks and months, clubs will be faced with lost revenue due to sustained closures and challenges related to retention of staff and members. Some clubs will emerge from this period with minimal negative financial impact, but for others the effects could be disastrous. The key determinants of a particular club’s outcomes will be a result of past decisions and its business model going into the crisis. This article is intended to provide some perspective on how the current crisis could be an opportunity to re-evaluate and reset your club’s business model.

Do Your Members Act Like Customers or Owners?

I belong to a local gym where I work out a few times per week. I joined, quite frankly, because it is convenient, and it was the least-expensive option in the area. I think like a customer when it comes to my membership. I paid no initiation fee to join the gym and I do not know the staff (nor do they know me). The experience is something I can get just about anywhere – it is a commodity, and it feels like it. I get no say in how the operation is run and I see no future improvements in sight that would enhance the value of my membership.

When the gym closed due to the stay-at-home order, I received a blanket email from the ownership asking that I consider continuing my dues as a donation to help keep the staff paid. While I may consider doing this for a month, anything further will cause me to drop my membership, as I do not feel vested in the business or its ongoing success. My relationship with the gym is purely transactional and I have no sense of attachment to the services or staff.

In contrast, I also belong to a local church where even though I am not technically an owner, I feel like I am and I behave accordingly. My membership provides a unique community I could not get anywhere else and is a great fit for me and my family. I know the church members and the staff and they know me. I serve on committees which allows me a say in the operation.

When the COVID crisis hit, I received a personal phone call from the pastor to see how I was doing and to ask if I needed anything. I am aware of the organization’s challenges, but I believe in the direction it’s taking and I want my kids to be a part of it as they grow older. The nature of my relationship with my church is such that I am not only willing to remain as a member and continue to give each month, but I am also willing to do what it takes to ensure the staff gets paid even though the building is temporarily closed. The church is a significant part of my family’s lifestyle and I am attached to the experience, the community and the staff.

A private club membership, especially an equity membership, should feel a lot more like the second scenario than the first. In times like we are currently facing, the mindset of the members is especially important. Members who think of themselves as customers will be resistant to disruptions in their routine or value proposition, even if the changes are in the best interest of the long-term health of the club. Members who behave like owners are willing to do what it takes to ensure the club’s success. So how can a club shift the member mindset from customer to owner? Here are four things to consider:

Budget for the Mission and Don't Compromise for the Budget

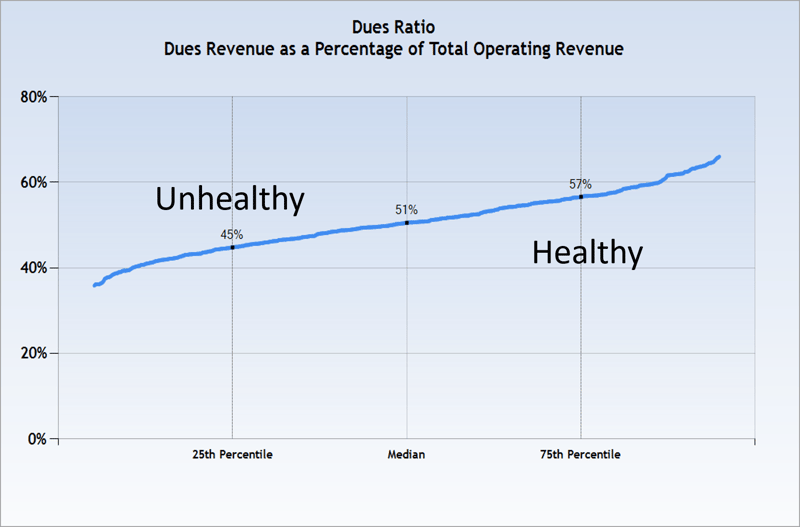

The concept of zero-based budgeting should be applied to both the operating and the capital budgets. On the operating ledger, clubs with golf should target a dues ratio (dues as a percentage of total operating revenue) of at least 50%. The dues ratio for non-golf clubs should be at least 39%. The further a club falls short of this target, the more dependent they are on revenue from facility usage (non-dues revenue) in order to meet the operating margin goal. That reliance on non-dues revenue leads to increased pressure to generate profitable income from largely non-member use of the facility such as banquets and golf outings.

Key Metric #1: Dues Ratio should be >50%

In many cases, this is caused by clubs attempting to “back in” to a specific dues rate target. Rather than setting dues rate at the level necessary to achieve the club’s mission, additional non-dues revenues are forecast to essentially subsidize a shortfall in dues revenue. Dependence on non-member use to fund the operating costs of the club is contrary to the fundamental concept of private club membership and can adversely affect the member experience. This is the classic case of the inability to see the forest through the trees, where meeting the operating budget becomes more important than delivering on the club’s mission. The long-term effects of this mentality are a decrease in the club’s value proposition, which leads to fewer members, less revenue from dues and initiation fees and ultimately a decline in the club’s net worth.

On the capital ledger, zero-based budgeting requires clubs to fund three items:

- Existing or Planned Debt Service

While most Clubs include interest on debt on the capital ledger, the USFRC (Uniform Standard of Financial Reporting for Clubs) puts it “above the line” which suggests it is an operating expense (CB follows this standard). Using our methodology, the operating result is net of the expense of interest on debt. Thus, clubs must consider principal payments as coming from capital.

- Obligatory Capital - Cost to maintain and replace existing capital assets

Replacement of existing capital assets should be based on a professional, objective capital reserve study completed by a third party. While most Clubs will adjust these numbers slightly each year, the study provides an independent and professional assessment of the club’s footprint, and capital fees should be charged accordingly. A simple test of how fresh or depleted the club’s assets are is found in the Net to Gross PPE ratio below.

- Aspirational Capital – Improvement projects

Clubs tend to engage in significant aspirational capital projects every 2-5 years. Accordingly, clubs should be looking out at the next 2-3 projects in order to determine appropriate funding mechanisms.

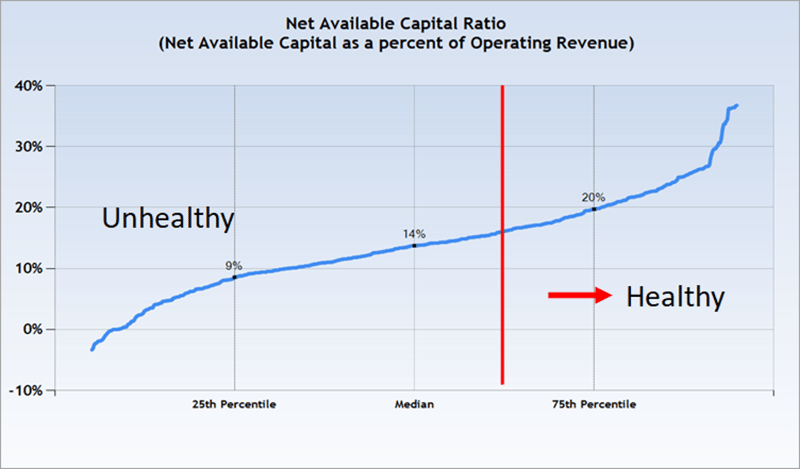

Key Metric #2: Net Available Capital Ratio should be >17%

The Net Available Capital Ratio is the most important ratio in determining if the club is generating adequate capital to drive the club forward. The Net Available Capital (NAC) calculation is Operating Net + Total Capital Income minus Lease Payments. To get the Net Available Capital Ratio, simply divide the NAC by the operating revenue.

Net Available Capital is the money the club has available to fund the three capital ledger needs described above. Based on Club Benchmarking analysis of over 1,000 clubs annually, the recommended target for NAC ratio is 17%. In most cases, this will provide clubs with the necessary capital income to replace capital equipment, fund debt service and build reserves to fund future aspirational capital improvements. It should be noted that the median Net Available Capital ratio for clubs with golf is 14% which is below our recommended target. Clubs which consistently generate less Net Available Capital than they need will ultimately face outdated and irrelevant facilities and/or a large membership assessment to address years of deferred maintenance.

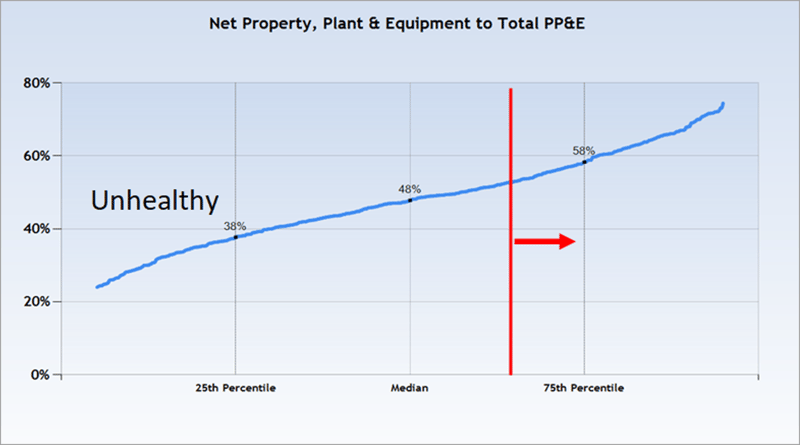

Key Metric #3: Net to Gross PP&E should be >55%

The Net to Gross Property, Plant and Equipment (PP&E) Ratio is a simple balance sheet test to show the relative condition of the club’s property, plant and equipment. Are the assets fresh and new or worn and depleted? The ratio takes Net PP&E (less land which isn’t depreciated) and divides it by the Gross PP&E (again less land). The higher the number the fresher the assets. A lower number represents assets which have been more depreciated.The industry median is 46% and CB’s recommended target is 55% or higher.

This ratio is critical to understand, as Net PP&E represents 80% of total assets on the balance sheet at the average club. It is important to point out that this ratio will spike with recent improvement projects or major replacements such as an irrigation system, but clubs should monitor the ratio over time to ensure that asset replacements are in line with member expectations. It should also be noted that this is a simple balance sheet test, and a capital reserve study is the most accurate way to evaluate the condition of assets.

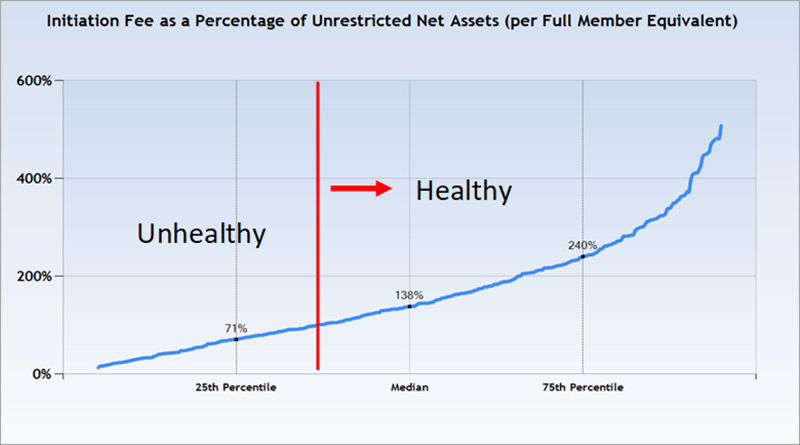

A Word of Caution Against Lowering Initiation Fees

While it is possible to stimulate short-term interest by lowering the club’s initiation fee, it is also a sure-fire way to teach your members to think like customers instead of owners. At the beginning of this article, it was noted that club’s whose members think and behave like owners will come out of our current crisis without serious negative financial impact. The initiation fee is the ultimate determinant of the club’s value proposition in its market and members who have paid a significant initiation fee to join feel vested in the long-term success of the club.

Looking at long-term strategy, consider the correlation between initiation fees and number of members to determine the wisdom of cutting initiation fees. Club Benchmarking data confirms that clubs with the highest initiation fees have the most members and clubs with the lowest initiation fees have the least members. Furthermore, clubs with the lowest initiation fees have the highest member attrition and the clubs with the highest initiation fees have the lowest attrition. A more appropriate strategy for clubs is to look for ways to increase their value proposition. Clubs don’t compete on price – they compete on value. The data shows that when clubs pack more value into the membership, more members are willing to join at an appropriate initiation fee. If the average age of your prospective new members is mid-40s, do you have a product that attracts that demographic?

Key Metric #4: Initiation Fee as % of Net Worth per FME should be >100%

While there are several metrics that can be used to evaluate initiation fees, the above ratio evaluates the initiation fee as a percentage of the club’s Unrestricted Net Assets (essentially its net book value) per full member equivalent. The ratio shows an incoming member’s initiation fee in the context of what the members have contributed in capital income over time minus accumulated depreciation. If the percentage is significantly below the median, the current members who have either paid higher initiation fees or contributed capital dues and assessments over their tenure are essentially funding a scholarship for new members.

Members Who are Engaged & Involved Think Like OWNERS

Beginning with the new member orientation, each club has the opportunity to consistently remind members that they are part of a special community. Telling the story of your club’s history and traditions gives members great pride in being a part of your club. Opportunities to do this in the club environment, along with communicating the vision for the club’s future are endless. Many clubs have history committees or communications and marketing committees that do an excellent job of instilling member pride. Be sure each team member can recite the club’s “Elevator Speech” about why people want to join your club and share it frequently with your members.

I have worked with many clubs that struggle with the customer versus owner mindset and have just a few extremely dedicated members who work tirelessly on the club’s behalf. Unfortunately, these few members take up the lion’s share of the responsibilities of governing the club while the majority of the membership are content to use the facilities and criticize the ideas and solutions from those that are working on their behalf.

It is critical for clubs to use the governance and committee structure to engage a large share of the membership in active participation. Members who understand the strategic issues the club is facing feel a sense of duty to participate in solutions. The committee process also facilitates a sense of community, strengthening bonds and relationships with both members and staff. Finding ways to increase participation through committees will go a long way towards cultivating the owner mindset.

Remind Your Members Who Owns the Club.

One of the most wonderful things about the finances of an equity-owned club is that members get to choose how to fund the club’s financial needs. All too often, private club leadership fails when it comes to an honest assessment of the true costs of running the club. Failure to adequately fund the operating ledger through dues revenue leads to a deterioration of the member experience. Failure to adequately fund the physical footprint through capital income leads to outdated and irrelevant facilities and amenities. One of the greatest challenges facing our industry is artificially low dues and fees.

True leadership at a private club is about reminding members that they are part of a special community and that all members share in the responsibility for adequately funding the club’s operations and physical assets to the mission. Each member plays a critical role in the club’s success; by paying the necessary dues and fees; by being an active participant in how the club is governed and by being an active promoter of the club in the community to keep membership interest healthy and vibrant. Members who think like owners behave in these ways because they want to contribute to the success of the Club. During this crisis, look for opportunities to improve the value members derive, and avoid knee-jerk, cost-cutting measures that reduce the value of membership in your club. Thoughtful, strategic, informed leaders will use this crisis to strengthen their clubs and improve our industry.

Club Benchmarking Executive Director Eric Gregory is a recognized club industry expert on the subject of capital planning and capital strategies modeling. His club career spans more than two decades including 10 years as GM/COO and an adjunct professorship teaching Advanced Club Management at Cal Poly - Pomona. Based in Southern California, Eric is a Club Benchmarking Regional Partner for clubs in CA, OR, WA, NV, UT, ID, AZ, HI. Email Eric Gregory or call 626-325-3486

.png?width=200&height=58&name=MicrosoftTeams-image%20(8).png)

.png)

-1.png)

-1.png)