Better Governance Begins with Board Education

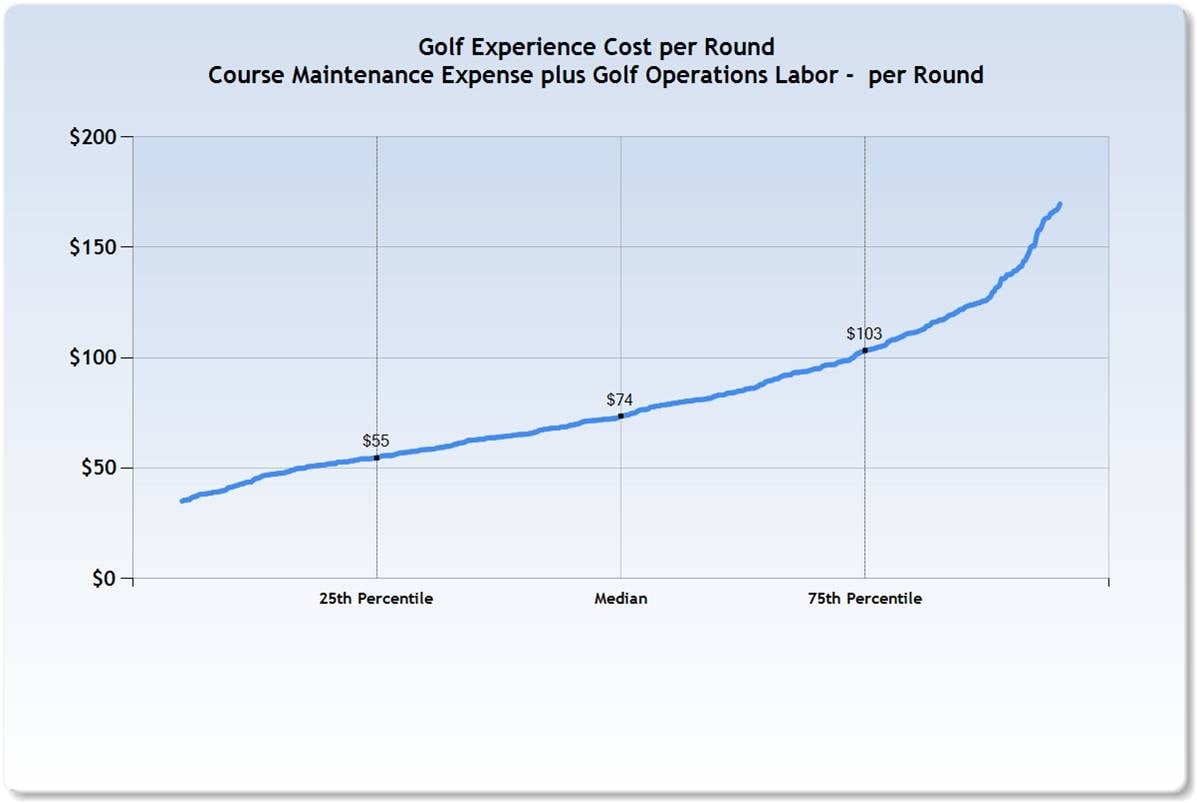

Know Your Club's Golf Experience Index

The experience of a round of golf can take on endless dimensions. Some days you may struggle through four hours of intense frustration and end up wondering why you play the game at all. Other times, you find...

What Spending on Golf versus Other Sports Says About Your Club’s Identity

Dividing the Pie In the club world, much like in our private lives, the need for funds is often greater than the supply. As individuals, we prioritize competing interests on...

Three Benchmarks that Define Your Club's Value Proposition

Value, as in the value of a product or service, is a subjective concept that can be difficult to measure. When it comes to determining the value of membership in a private club, there are...

Food and Beverage is certainly one of the most important amenities in a private club, but it's also one of the most misunderstood in terms of its financial impact. Many boards get...

Revenue Realities in Private Clubs

In any business, strategic leadership demands consideration of one essential question: How can we deliver value to our customers in a way that fulfills our financial objectives? The answer to that question shapes...

.png?width=200&height=58&name=MicrosoftTeams-image%20(8).png)