Questions are the Key

You’ve heard the phrase “measure what matters,” but how do you decide what really matters for your club? While the answer may vary from club to club, the goal is still the same—to identify a set of measures that can be used to accurately assess, manage and predict financial and operational performance. Deciding what to measure begins by figuring out what you need to know about your club. In Einstein’s words, you start by “determining the proper questions to ask.”

Through extensive study of club industry data, we have identified a set of key questions that correlate directly to the financial and operational health of a club and developed specific metrics and ratios that will answer those questions. The resulting standardized Executive Dashboard of Key Performance Indicators for the club industry establishes a common framework and common language for “measuring what matters.” The intent of the Executive Dashboard is to provide clubs with a properly focused set of metrics that help Boards concentrate on what does matter and, more importantly, keeps them from being distracted by what does not matter.

The Executive Dashboard identifies KPIs in five categories: Operating Finance KPIs; Capital Generation KPIs; Operational KPIs; Membership KPIs, and Debt KPIs. We’ll cover all five categories in a series of posts. This first installment will look at the four key questions and Key Performance Indicators related to Operating Finance.

Key Question #1

How much money is available to cover the club's fixed operating expenses?

KPI: Gross Profit (aka Available Cash)

Calculation: Membership Dues + (F&B Net = F&B Rev. – F&B Exp.) + (Rooms Net = Rooms Rev. – Rooms Exp.) + (Other Net = Other Op. Rev. – Other Op. Exp.) + (Golf Ops Rev. – (Golf Ops Exp. – Golf Ops Labor)) + (Yachting Net = Yachting Rev. – Yachting Exp.) + Ancillary Sports and Recreation Revenue

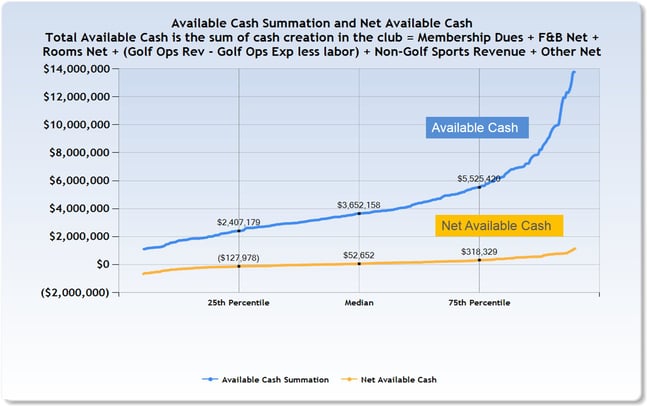

Relevance: The importance of understanding Available Cash cannot be overemphasized. Dues revenue is by far the dominating contributor to AC. A relatively high or low level of Available Cash is most often correlated to the mix of dues and food & beverage revenue. As in any business, lower gross profit (Available Cash) tends to result in a weaker operating bottom line, and higher gross profit (Available Cash) tends to result in a stronger operating bottom line. Chart 1 below shows Available Cash for the median club in the CB database was $3.6M in fiscal year 2014.

Key Question #2

Does our revenue mix produce adequate margin?

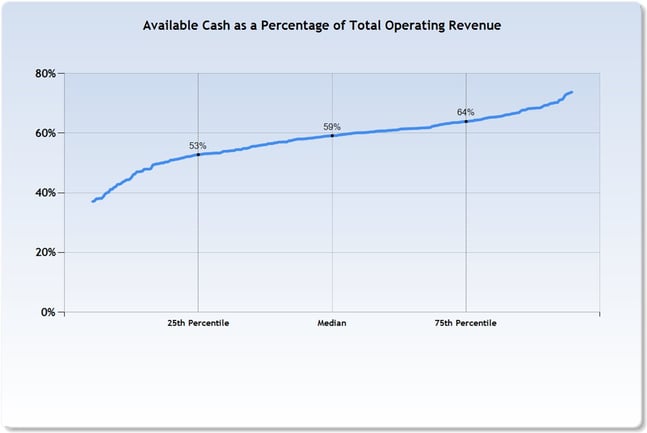

KPI: Gross Margin (Available Cash to Operating Revenue Ratio)

Calculation: Available Cash Ratio = Available Cash/Operating Revenue

Relevance: Variation in the AC Ratio can usually be explained by observing the mix of dues revenue and F&B revenue. Clubs with a high AC ratio tend to have a larger proportion of operating revenue from dues and lower proportion from F&B. Clubs with lower AC Ratios have the opposite mix and those clubs typically struggle to achieve operating breakeven (see Net Available Cash below) because there is not enough Available Cash to cover fixed expenses. By itself, a lower AC Ratio does not necessarily identify a problem, but coupled with a negative Net Available Cash it is likely indicative of a weak dues engine. Chart 2 below shows the median ratio for all clubs in the CB database was 59 percent fiscal year 2014.

Key Question #3

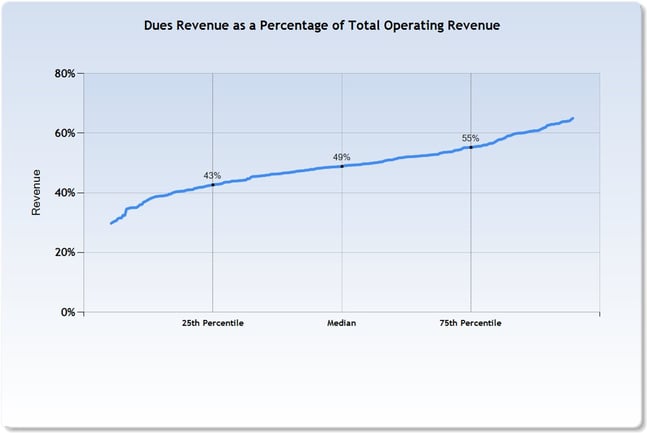

Is the dues component of our revenue suitable?

KPI: Membership Dues to Revenue Ratio

Calculation: Membership Dues Ratio = Membership Dues/Operating Revenue

Relevance: Dues revenue is THE financial driver in clubs and this KPI assesses what proportion of your club’s operating revenue is driven by dues (a club’s most profitable revenue). A low Membership Dues ratio cannot be ignored and deserves intense focus. A low MD Ratio often occurs where member counts (FMEs) are low and/or dues per member are low. Chart 3 below shows the median MD Ratio was 49 percent for all clubs in the CB database in fiscal year 2014.

Key Question #4

Do we produce enough money to fund operations? Do operations draw money from or produce money for capital?

KPI: Operating Bottom Line (Net Available Cash)

Calculation: Net Available Cash = Available Cash – Course Maintenance Expense – G&A Expenses – Building Maintenance and Operation Expense – Sports and Recreation Expense – Golf Operations Labor – Fixed Charges (Fixed operating expenses exclude any expenses related to leases which are considered a capital expense.)

Relevance: Ideally, Net Available Cash will be break-even or positive since any deficits must be covered by subsidies that flow from the capital side of the ledger. Nearly 80 percent of a club’s Available Cash comes from dues revenue, so a negative result in Net AC is often the result of dues revenue being too low to support expenditures. Another possible cause is that fixed expenses are too high. The key is to understand the operating bottom line result as it stands, without any shifting of capital income. Chart 1 above shows median Net Available Cash for all clubs in the CB database was $53K for fiscal year 2014.

CLICK HERE to download a sample copy of the Executive Dashboard Report

WATCH THE VIDEO: "INTRODUCTION TO THE EXECUTIVE DASHBOARD"

The Executive Dashboard identifies KPIs in five categories: Operating Finance KPIs; Capital Generation KPIs; Operational KPIs; Membership KPIs, and Debt KPIs. We’ll cover all five categories in this series. NEXT IN THE SERIES: CAPITAL KPIs

.png?width=200&height=58&name=MicrosoftTeams-image%20(8).png)

.png)

-1.png)

-1.png)