Capital Generation KPIs Bring the Future into Focus

In Part 1 of our Executive Dashboard series we introduced the idea of key questions for club leaders, the measures that can be used to answer those questions and the first section of the Club Benchmarking Executive Dashboard -- key performance indicators related to operating finance.

The “Capital Generation” section of the Executive Dashboard is comprised of three Key Performance Indicators that correlate directly to a club’s future. Healthy capital generation supports ongoing investment in the kind of facilities and amenities that a club must have to attract and retain members in an increasingly competitive market. Inversely, inadequate capital generation can lead to deterioration of the club’s offerings, declining membership and over time a financial and operational spiral that is difficult to reverse. This section of the Executive Dashboard helps club leaders assess the current state of their capital generation “engine” and determine what if any adjustments are needed to move the club toward the desired future outcomes.

Key Question #1

How much capital income did we produce?

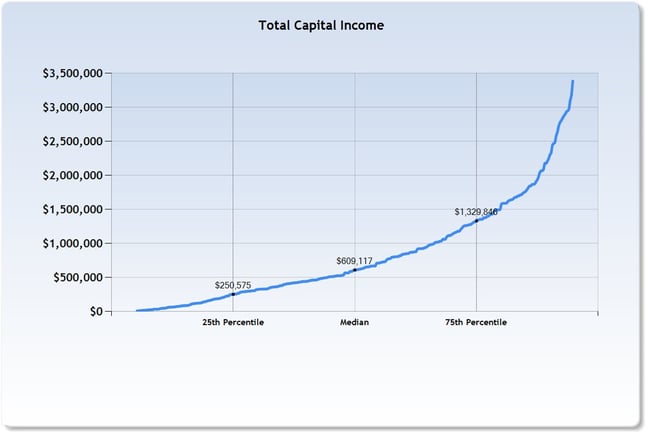

KPI: Total Capital Income

Calculation: Total Capital Income = Net Initiation Fee Income + Capital Dues + Capital Assessments + All Other Capital Income (Property Sales, Net Profit from Tournaments, Gifts and Donations, Other)

Why It Matters: Total Capital Income (TCI) is the income from all capital sources. The “capital engine” of a club is the key to having the money necessary to continuously make the capital investments necessary to maintain and upgrade the club’s facilities and amenities. Updated and compelling facilities and amenities are the heart of any club’s value proposition and are critical to maintaining and growing a vibrant, sustainable membership.

Common capital income sources include initiation fees, capital dues or assessments, sale of property, investment income, or any operating surplus (positive Net Available Cash). Given that capital needs are fairly consistent, clubs must strive for capital income that is also consistent over time. It is one of the most critical aspects of a Board’s governance and a management team’s duty to assure that capital income matches capital needs into the foreseeable future. Predictability in capital income is necessary and may drive clubs to consider capital dues as one key source of predictable capital income. The chart below shows that for fiscal year 2014, the median club had Total Capital Income of about $609K.

Key Question #2

How much capital is available after adjusting for operating loss or gain?

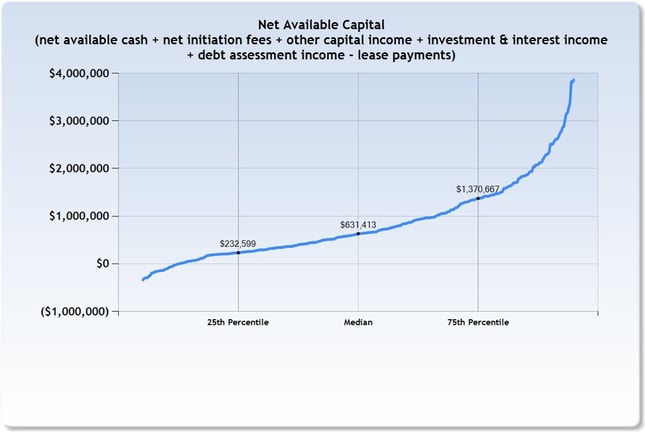

KPI: Net Available Capital

Calculation: Net Capital Available = Total Capital Income + Net Available Cash – Lease Payments

Why It Matters: Net Capital Available is ultimately more important than Total Capital Income. NCA is the amount of capital available for investment or debt reduction AFTER any possible operating subsidies as a result of negative Net Available Cash and after covering equipment lease expenses. Operating deficits (negative Net Available Cash) must draw money from capital income decreasing Net Capital Available. Conversely, an operating surplus contributes to the NCA.

Clubs with relatively low NCA must determine whether the weakness is caused by low TCI or by cannibalizing from capital to shore up operating deficits (negative Net AC). If the former is the case, implementing or increasing capital dues should be considered. If the latter is the case, focus should be on eliminating the operating deficit. Consistently strong NCA has a cumulative positive effect on a club by allowing continuous investment in the club. Consistently weak NCA has a negative effect over time which manifests as outdated and poorly maintained facilities and amenities.

Just as a clear view of NCA over time is mandatory, so is a capital reserve study. Clubs with a strong strategic plan and strong governance foundation understand the key to long term success is continuously matching Net Capital Available with capital needs year after year. A capital reserve study is the accurate view of the needs without which it is impossible to gauge the capital resource requirements of any club. The chart below shows that fiscal-year 2014 median NCA for all clubs in the CB database is about $631K.

Key Question #3

Do we produce sufficient capital?

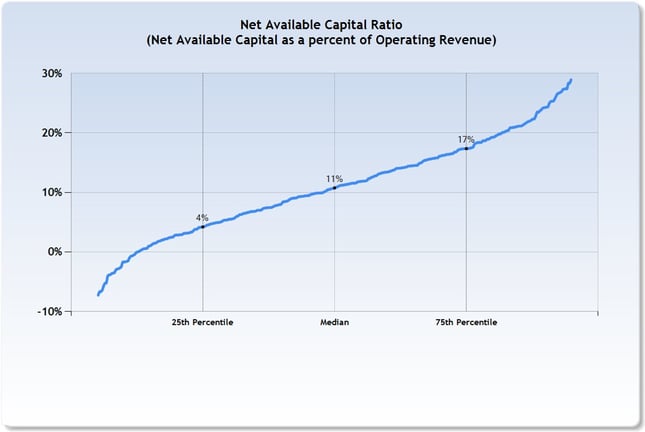

KPI: Available Capital to Operating Revenue Ratio

Calculation: Net Capital Available Ratio = Net Capital Available/Operating Revenue

Why It Matters: The Net Capital Available Ratio is simply the Net Capital Available divided by the club’s operating revenue. Significant analysis has led to the conclusion that a sustainable level of Net Capital requires a Net Capital Available Ratio of approximately 12 percent. While clubs below the 25th percentile on this measure tend to be capital starved a capital reserve study is always necessary to precisely determine a club’s actual capital requirements. The chart below shows that fiscal-year 2014 median is 11 percent for all clubs in the CB database.

To learn more about the Club Benchmarking Executive Dashboard, CLICK HERE

.png?width=200&height=58&name=MicrosoftTeams-image%20(8).png)

.png)

-1.png)

-1.png)