In our 2023 Club Governance Survey Report, we noted gaps in board education and alignment across the industry. For clubs that did not embrace comprehensive board education, the result was inconsistent practices and understanding in such key areas as strategic planning, long-term financial planning, and management of debt. A total of more than 1,200 individuals responded to the survey, representing 801 clubs from across North America.

More than half of all survey respondents (50%) indicated that succession planning for board members and officers was not considered effective. The risks for a private club not having effective succession planning, especially given the relatively short terms of board members and officers, are that strategic plans may be shelved; short-term thinking replaces strategic thinking; boards pursue projects versus cohesive long-term plans; personal agendas creep into governance activities; and inconsistent planning and implementation results. None of these benefit the long-term viability of a club.

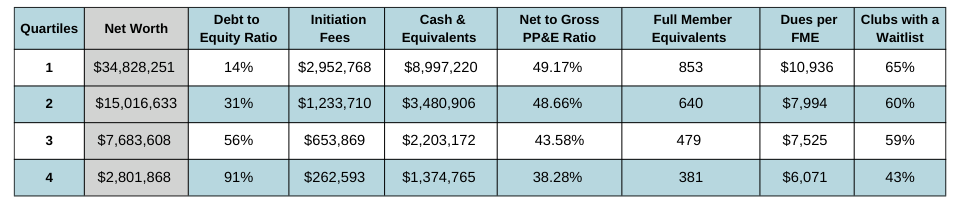

With the goal of quantifying the correlation between governance and financial results, we analyzed available financial data from 412 responding clubs to calculate key financial performance metrics such as net worth, debt-to-equity ratio, debt-to-dues ratio, and capital dues relative to depreciation. As an example, Chart 1 below groups the clubs into quartiles based on net worth, ranging from most favorable to least favorable results.

Chart 1: Key Financial Performance Metrics (412 responding clubs)

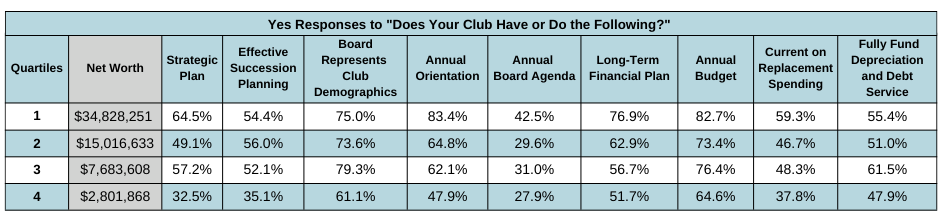

The next step was to break out the percentage of “yes” answers to key governance questions in the survey, with “yes” being the most positive response:

- Does the club have a strategic plan?

- Does the club have effective succession planning for the board?

- Is the board representative of the club's demographics?

- Does the club conduct an annual orientation for the board?

- Does the board have an annual agenda?

- Does the club have a long-term financial plan?

- Does the club prepare an annual budget?

- Is the club current on capital replacement spending?

- Does the club fully fund depreciation and debt service?

Those answers were then correlated with financial data from clubs in each quartile. What we found was that in general, clubs in the first quartile for net worth had the greatest number of “yes” answers for key governance questions. The number of “yes” answers declined moving from the 1st quartile to the 4th, and the number of respondents answering “not sure” increased. A compelling case can be made that clubs adhering to governance best practices achieve better financial performance and greater overall success.

In Chart 1 above, we see that clubs with higher net worth tend to have lower debt-to-equity ratios and higher initiation fees, cash & equivalents, full member equivalents and dues. They also tend to have more up-to-date facilities as evidenced by higher net-to-gross property plant & equipment. In addition, a higher percentage of clubs in the 1st quartile have a waitlist. As net worth decreased, there was a higher reliance on the use of debt relative to equity and lower initiation fees, cash, FME’s and dues. Clubs, particularly in the 4th quartile, were not keeping their facilities up to date as indicated by the net to gross property plant & equivalent ratios. A lower percentage of clubs in that quartile have wait lists.

Chart 2: Percentage of “Yes” Survey Responses by Quartile

In each category, the number of clubs with “yes” answers declined as net worth decreased. Additionally, for responses related to issues such as effective succession planning, funding of depreciation and debt service and existence of an annual budget, the percentage of “not sure” answers increased from the 1st quartile to the 4th quartile.

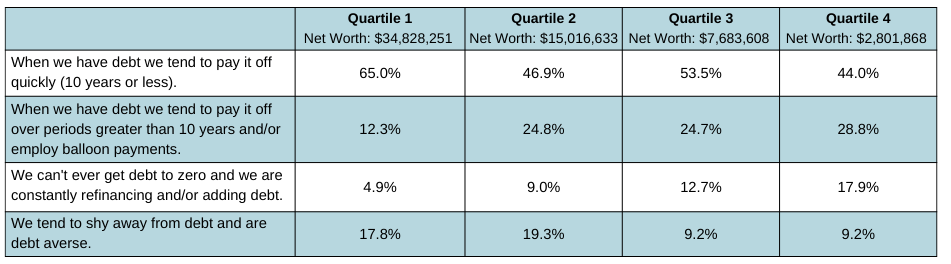

Chart 3: Use of Debt

Clubs in the 1st quartile employed better practices of managing debt than clubs in the other quartiles, particularly the 3rd and 4th.

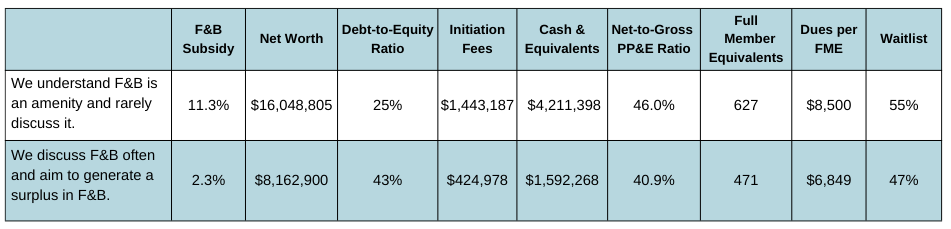

We also have advocated for boards to spend 65% to 70% of their time on forward-looking planning and strategy versus operational issues such as F&B results. In our survey, more than 50% of respondents indicated that they understand F&B is an amenity and rarely discuss it in board meetings. Approximately 12% responded that F&B is discussed often, and the club aims to generate a surplus in F&B.

Chart 4: Financial Results Based on the Club’s Approach to F&B

For clubs where focus was on discussing F&B and aiming to generate a profit, financial results were not as favorable. It should come as no surprise that clubs in the upper quartiles of financial performance recognize F&B as an amenity and spend less time discussing it.

Our conclusion based on this analysis is that good governance practices yield better financial results. Clubs following best practices in club governance have stronger balance sheets, higher initiation fees to fuel capital spending, more up-to-date facilities, higher dues, and more members. Good governance requires board education to ensure solid understanding of all aspects of the club and the industry. Strong, effective boards follow a strategic plan with a long-term capital plan that fully funds future obligations including capital spending and debt service, and they embrace succession planning to get the right people in place now and in the future.

To download a printable PDF of this article CLICK HERE

To receive a copy of the 2023 Governance Survey Report and/or a complete copy of the survey results, or to discuss the option of using the survey as a board self-evaluation at your club, please don’t hesitate to reach out to Joe Abely at jabely@clubbenchmarking.com (781-953-9333) or Dave Duval at dduval@clubbenchmarking.com (617-519-6281)

.png?width=200&height=58&name=MicrosoftTeams-image%20(8).png)

.png)

-1.png)

-1.png)