-1.png?width=722&name=Featured%20Social%20(2)-1.png)

Taking on long-term debt at a private club is one of the most important decisions a board can make. The long-term consequences of taking on debt will limit the flexibility of the club and future administrations for many years to come.

The capital needs of a private club are nearly insatiable, and ongoing replacement (obligatory capital) and improvements (aspirational capital) are always just around the corner. Clubs that are not consistently improving through capital investment are falling behind. Board members must be cognizant of this fact and plan accordingly. Without a forward-looking 10-year capital plan, it is all too easy to underfund the club's long-term capital needs and/or to misuse debt. In all situations, the addition of debt will complicate future financing options until it has been repaid. For this reason, with few exceptions, short to intermediate debt terms are preferred.

Borrowing funds is only one side of the equation. The loan creates a fixed commitment that must be repaid with a fixed source of capital funds. Separately billed debt service fees are often most appropriate. Such a fee is simply member assessments spread out over time. Club leaders must be diligent in planning and pairing future fixed inflows with the debt service costs. While it can be tempting, club leaders must avoid diverting existing capital flows that should be used for capital investment to the service of debt. Club campuses decline quickly without constant rejuvenation.

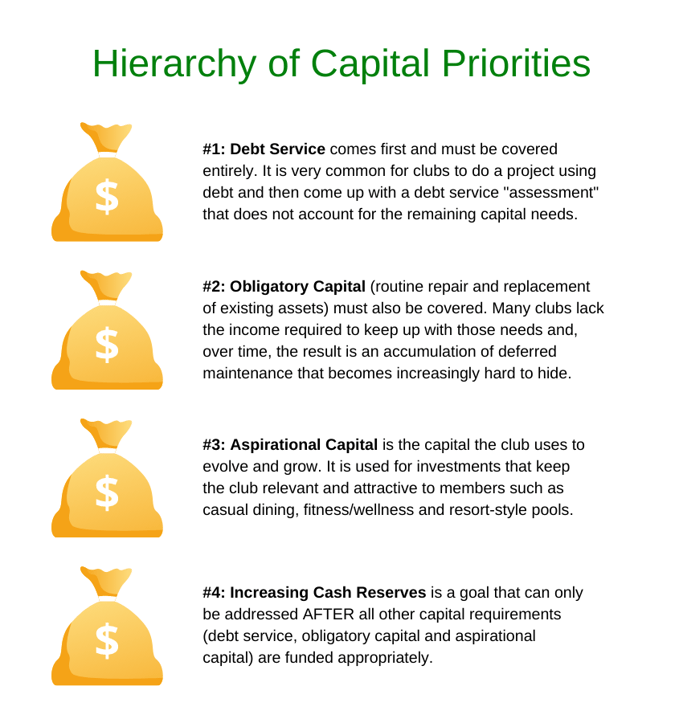

In the hierarchy of capital priorities, debt service is a fixed commitment that takes priority over all other uses of capital.

As you consider this hierarchy, it is important to match capital revenues with related outflows throughout the plan. We recommend the following allocation of resources:

-

Annual debt service fees charged separately to members should equal the Debt Service. These are best thought of as member assessments spread out over time. Debt is not a substitute for member equity.

-

Annual capital fees should be set to fund Obligatory Capital needs of the forward-looking plan. Ideally these needs are based on a comprehensive professional replacement reserve study. At a minimum, these fees should match annual depreciation adjusted for inflation. If the club has fallen behind in accumulating sufficient reserves to cover obligatory needs, the use of short to intermediate term debt may be necessary as a one-time correction of prior funding deficiencies. Repeated use of debt to address obligatory spending is to be avoided.

-

Aspirational Capital spending evolves the club’s campus, making it more appealing to current and future members. Funding for aspirational needs typically comes from accumulated net initiation or transfer fees, operating surpluses, member assessments, and debt (assessments spread over time). It is typical for clubs to undertake one or two large aspirational efforts within a ten-year planning window. This frequency begs the need for shorter loan periods. Longer terms will complicate future financings and/or result in a refinancing need and the creation of “Zombie debt" which is debt that never gets fully extinguished and is detached from the original need. When amortization periods are too long, the debt overhang limits future opportunities and/or may result in an unfunded balloon payment.

There are many more factors to consider in the use of debt in private clubs. By definition, debt is unforgiving and as such it must be used judiciously. We can help you avoid the problems that time has exposed at other clubs. To learn more about our approach, contact the authors directly or visit us online at www.clubbenchmarking.com/board-services

About The Authors Dave Duval is a member of Charles River Country Club, The Quechee Club, Turtle Creek Club and Portmarnock Golf Club. He served on the board of Charles River Country Club for eight years, including six as Treasurer, before joining the board of The Quechee Club. He served on The Quechee Club board for four years including two as President & CEO. During the course of his club board experiences, Dave architected the long-term funding plans and finances for more than $20 million of capital improvements. He also oversaw multiple membership surveys and governance improvements while communicating frequently about board activities and membership satisfaction. Dave’s professional experience includes public accounting, C-suite management and 20 years as a partner in venture capital partnerships. He is a CPA (retired) and holds a BS in Accounting from Bentley University and an MBA from Babson College. Dave has served on numerous corporate, association and charitable organization boards. Email: dduval@clubbenchmarking.com

Dave Duval is a member of Charles River Country Club, The Quechee Club, Turtle Creek Club and Portmarnock Golf Club. He served on the board of Charles River Country Club for eight years, including six as Treasurer, before joining the board of The Quechee Club. He served on The Quechee Club board for four years including two as President & CEO. During the course of his club board experiences, Dave architected the long-term funding plans and finances for more than $20 million of capital improvements. He also oversaw multiple membership surveys and governance improvements while communicating frequently about board activities and membership satisfaction. Dave’s professional experience includes public accounting, C-suite management and 20 years as a partner in venture capital partnerships. He is a CPA (retired) and holds a BS in Accounting from Bentley University and an MBA from Babson College. Dave has served on numerous corporate, association and charitable organization boards. Email: dduval@clubbenchmarking.com

Joe Abely is a member of Brae Burn Country Club and The Wianno Club. During his twelve years of board service at Brae Burn he served as Treasurer for six years and President for three. He continues to chair the nominating committee there. Joe also architected the long-term funding plans and finances for more than $20 million of capital improvements during his tenure and prioritized membership satisfaction and communications. In addition to serving on many corporate and tax-exempt organization boards, Joe’s career accomplishments include partnership in a Big 4 CPA firm, CFO/COO/CEO of a publicly traded company and serving as Executive Director of a large charitable organization. He is a graduate of Boston College and holds an MBA from The Wharton School of the University of Pennsylvania. Email: jabely@clubbenchmarking.com

Joe Abely is a member of Brae Burn Country Club and The Wianno Club. During his twelve years of board service at Brae Burn he served as Treasurer for six years and President for three. He continues to chair the nominating committee there. Joe also architected the long-term funding plans and finances for more than $20 million of capital improvements during his tenure and prioritized membership satisfaction and communications. In addition to serving on many corporate and tax-exempt organization boards, Joe’s career accomplishments include partnership in a Big 4 CPA firm, CFO/COO/CEO of a publicly traded company and serving as Executive Director of a large charitable organization. He is a graduate of Boston College and holds an MBA from The Wharton School of the University of Pennsylvania. Email: jabely@clubbenchmarking.com

.png?width=200&height=58&name=MicrosoftTeams-image%20(8).png)

.png)

-1.png)

-1.png)