It’s estimated that a new car loses about 10% of its value the minute you drive it off the lot, and as much as 20% in the first year of ownership. We have no trouble understanding that the car still has a certain amount of value if we were to sell...

Originally published in the Winter 2022 issue of National Club Association's Club Director magazine

If you are a leader of a top-tier private club (or a club that aspires to be top tier), you understand that relevance is not just a buzz word—it is...

Taking on long-term debt at a private club is one of the most important decisions a board can make. The long-term consequences of taking on debt will limit the flexibility of the club and future administrations for many years to come.

Transformative investments of millions of dollars are reshaping private club campuses everywhere, and “What’s this going to cost?” is a question often raised in member forums and club board meetings. Club leaders need to put in the work and be...

Now Might Be a Good Time to Rethink Your Club’s Business Model...

Over the coming weeks and months, clubs will be faced with lost revenue due to sustained closures and challenges related to retention of staff and members. Some clubs will emerge from...

By Jim Butler, CEO - Club Benchmarking

It's time to stop planning one year at a time and start building capital budgets with a clear vision for the future of your club

Summer is flying by and the capital and operating budget process will soon be upon us. Annual operating budgets are...

Originally published by the National Club Association, Club Director Magazine

Originally published in NCA Club Director Magazine Fall 2018

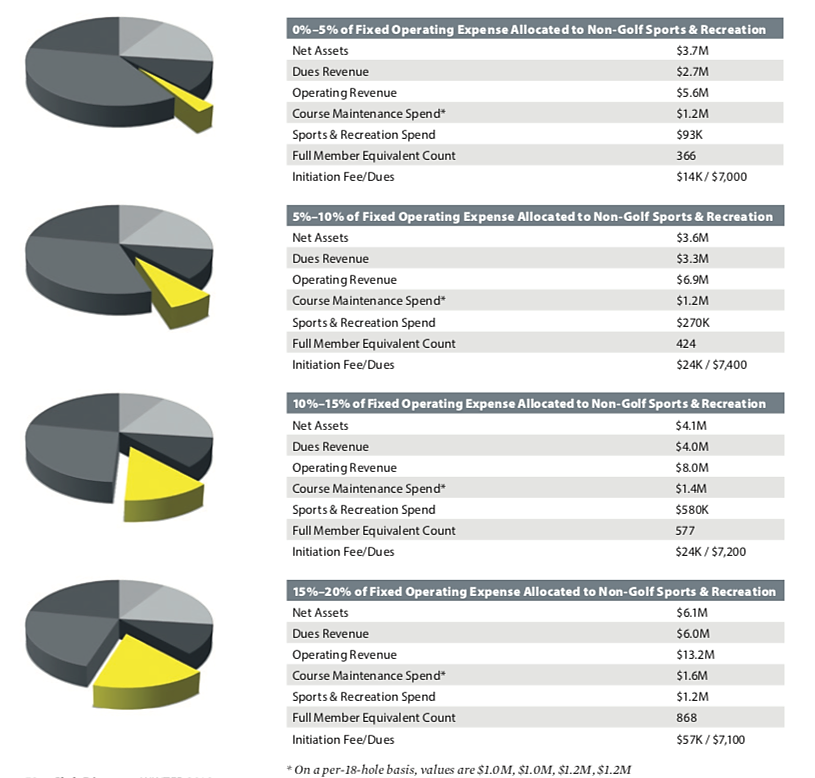

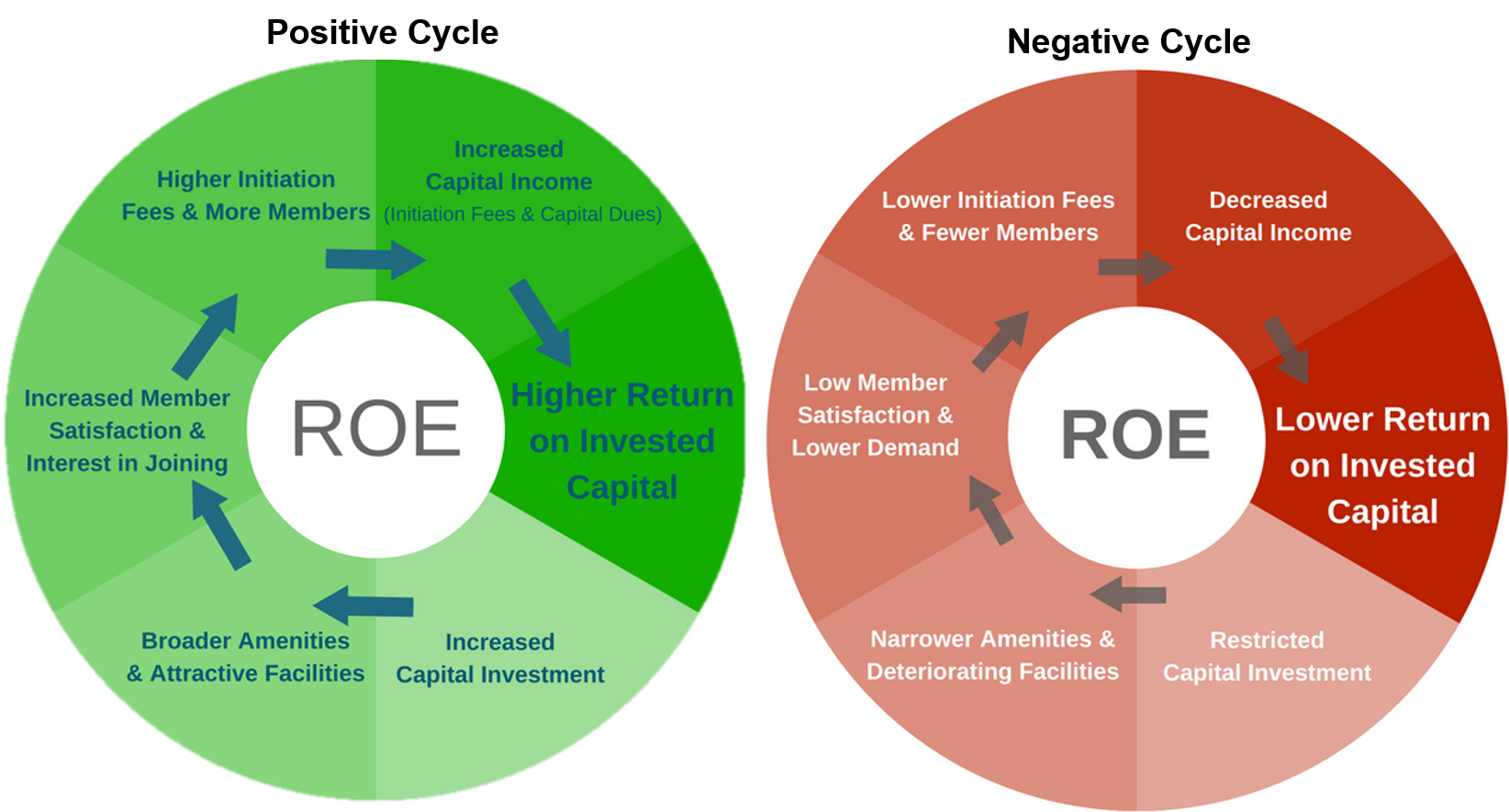

CLUB BENCHMARKING DATA REVEALS a “Tale of Three Cities” happening in the club industry, and we are deeply concerned about what appears to be a growing divergence. According to our...

.png?width=200&height=58&name=MicrosoftTeams-image%20(8).png)