What Spending on Golf versus Other Sports Says About Your Club’s Identity

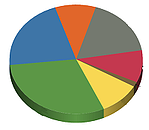

Dividing the Pie

In the club world, much like in our private lives, the need for funds is often greater than the supply. As individuals, we prioritize competing interests on a regular basis—a new car, college tuition, family vacation, etc. For the club manager and board member, the struggle manifests itself in the budget process, where the true tribal nature of clubs comes to the surface. One group of members may be focused on golf while another contingent is keen on non-golf athletic amenities such as tennis, aquatics, fitness, squash, croquet, etc. Some golf-focused clubs may be feeling the pull to add non-golf facilities in order to re-connect with existing members or win over less golf-centric prospects.

While the money to build non-golf amenities (fitness centers, tennis courts, etc.) most often comes out of capital funding sources, sustaining the new amenity requires operational dollars from dues or other surplus generating departments. Simply building a tennis court or fitness center does not necessarily mean it will generate incremental operational funds, which raises an important question: "How much will it cost to operate the new facility and where will that money come from?"

Patterns in the Pie

The Financial Insight Model is a strategic framework for understanding a club’s proportionate sources and uses of gross profit. Early on in our study of industry data, it became clear that clubs typically spend about one-third of their gross profit on course maintenance. That number has proven consistent across the industry. Another very interesting pattern that emerged from the data is a direct relationship between course maintenance spending and the spending for non-golf sports amenities.

Club Benchmarking data shows a marked consistency across the industry where the combined percentage of gross profit going to course maintenance and the operation of non-golf amenities typically totals 40%. Golf-only clubs spent about 40% of their gross profit on the course and nothing on non-golf sports amenities, while clubs that have very significant non-golf sports/spa facilities are spending an average of about 15% on those facilities and 25% on the course. Within the spectrum, we find clubs allocating 30% course/10% non-golf, 36% course/4% non-golf, etc. This is one of the most clearly-defined patterns we have seen emerge since we began studying club industry data in 2009.

Walk the Talk

Does your club’s allocation of operational dollars align with its goals? Does your spending reflect that of a dedicated golf club, a diverse country club with a family focus, or some variation on those themes? There is no right and wrong here. Just the revelation that a club can instantly see and understand whether its actual spending is in line with its stated strategy -- or not. If you claim to be a family-friendly club with amenities for the whole family and you are allocating 30% to the course and 10% to non-golf sports, you are staying pretty true to that objective in your proportionate spending. If the balance is 37% to course maintenance and 3% to non-golf sports, your spending is inconsistent with the family-friendly claim. When it comes to facilities and club culture, you can't be all things to all people. You have to make a strategic decision about what kind of club you want to be and then target spending in a manner that supports those goals.

Additionally, with this new-found understanding, a club thinking about expanding its offerings can extrapolate and estimate the impact of those changes on their budgets and funding needs. Most often we see golf clubs attempting to build and offer non-golf activities. The net result could mean a reduction of course maintenance spending to support the new operations, or it could have no impact on the course budget if the new amenities succeed in attracting new members and the associated increase in dues revenue.

Conclusion

The club business model is defined by the relative uses of operational funds. One of the relations made clear by actual industry data is that 40% of a club's gross profit is allocated to the combination of course maintenance spending and non-golf sports spending. Understanding the direct connection between course maintenance spending and non-golf sports spending as it relates to the club’s strategic goals is pivotal for managers, boards and members as it can serve as a catalyst for meaningful discussions and help align disparate tribes (e.g. golfers vs. tennis players) around a common goal.

CB Member Note:

Login to your CB account and run the Gross Profit - KPI report from the My Reports tab to check your Golf/Non-Golf spending pattern.

.png?width=200&height=58&name=MicrosoftTeams-image%20(8).png)